Claiming Expenses

As a contractor, trying to get your head around what you can and can't legitimately claim as expenses can often be something of a minefield. For example, do you know whether or not you can claim for professional subscriptions and protective clothing. Can you claim for travel and subsistence under SDC (Supervision, Direction or Control)?

At Saymore, we know it's perfectly OK to claim for professional subscriptions and protective clothing, as long as they are used 100% (wholly & exclusively), for work related purposes and nothing else. In addition, we have the expertise to help you identify all the other expenses you're entitled to claim for whilst working on your contract.

Unlike less reputable Umbrellas, we don't believe in encouraging our contractor employees to exploit grey areas in the tax system. HMRC are constantly on the lookout for the exploitation of loopholes in tax legislation and will quickly step in to put a stop to any perceived 'perks'.

Here at Saymore, we don't do things half heartedly, which is why you won't find an assumptive online salary calculator on our site. Your decision to join an Umbrella should be based solely on the relevant facts and the service we provide, which is what our New Business Team are dedicated to providing you with. Remember, we are here to help and we can advise you on which business expenses you can legitimately claim

Remember all expenses must be budgeted for BEFORE each new contract. To find out more please contact our New Business Team today, by calling 01992 279 759

There are two distinct types of business expenses that you can process using Saymore your account. The first and most common are Saymore Business Expenses, while the second are Rechargeable Expenses, which are charged directly to your End Client.

These are the costs incurred in the course of running your day-to-day business and they are processed, along with your pay, without being subject to Tax and NIC.

These are the costs incurred in the course of running your day-to-day business that have been authorised by your end Client or Agency and will be fully reimbursed by them. Rechargeable Expenses can include a wide range of items and/or services and must be clearly identified and agreed with your end Client or Agency before the commencement of any contract.

These expenses are reimbursed to you in full, and should not be confused with your Saymore Business Expenses.

Rechargeable Expenses should be submitted together and for the same period as your timesheets, so that they can be billed to your Agency/Client on the same invoice and paid accordingly.

So, we hear you ask, what can I claim? Unfortunately, there are no set rules regarding the type or value of Rechargeable Expenses you can claim, because they form part of the agreement between you and your Agency/Client. You should always agree what, if anything, you can claim and how you go about making this claim before you start your contract; this should all be discussed in your contract negotiations.

Our policy on claiming Saymore business expenses

In order to ensure your expense claims are processed and paid as quickly as possible, you should be aware of and understand the following points:

- You cannot claim expenses incurred prior to you joining Saymore Umbrella, only those contracts whilst with us.

- All claims must only be for expenses incurred wholly, exclusively and necessarily in the performance of your contractual duties.

- In order to prevent delays or complications in the processing of pay and expenses, (which can result from overlapping time periods), expense claims should always cover the same period as the timesheet being submitted.

- You must not submit travel and subsistence related claims for any one location that you have already worked at or know you will work at, for more than 24 consecutive months.

- Where required, you must submit all necessary supporting evidence associated with a particular claim, such as receipts and proof of purchase or usage.

Business mileage

Under HMRC current rules you can claim 45p per mile for the first 10,000 business miles you do in your own vehicle each tax year and 25p per mile thereafter.

This mileage includes travelling to and from temporary workplaces you may be required to visit. Mileage, meeting these criteria, may be claimed without the need to submit receipts. However, a mileage log must also be completed and submitted, along with your expense form, to Saymore.

Daily food & drink claims

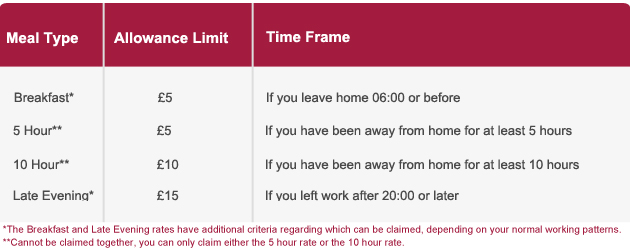

Subsistence as it's more commonly known, can be claimed whilst on contract if it meets the qualifying criteria and has been incurred in the course of business. Saymore Umbrella has adopted a system of scale rate expenses, similar to those specified by HMRC, in relation to subsistence expenses.

Under this system, if an employee has incurred subsistence expenses whilst travelling on an allowable business journey, employers are able to make Tax and NICs free payments up to the specified rates allowed. Therefore, as a flexible worker, employed at a temporary workplace, you are entitled to make a claim for allowances to cover meals. This is based on the hours worked on that particular day at the temporary workplace, as long as you actually do incur the cost of food and drink.

To ensure you remain compliant you are only eligible to receive these expenses if you can show that you have met the qualifying criteria specified for every expense you claim, as laid out in the table below.

Overnight accommodation

You can legitimately claim for reasonable accommodation expenses when overnight stays away from home are required as part of your contract.

If you are claiming accommodation rental costs, you must provide the original signed rental agreement, which must meet HMRC Dual Purpose rules, stating that you are only claiming for the working week. Claims are subject to the temporary workplace rule and if you are staying at a hotel or a B&B, the cost for the room, excluding meals, room service and beverages, will be processed.

Proof of overnight stay at a location other than your correspondence address is required, including the period/length of stay that was charged for, along with details of why an overnight stay was required.

This rule also applies to overseas accommodation, although if there is any element of private use, for example a holiday, within this period, the expense would be applied on a pro rata basis.

Incidental Overnight Expenses

If you are required to stay away from your home and overnight, as part of a qualifying business journey, you may make a claim for an 'Incidental Overnight Expense' (IOE) for each night of your required stay. The amounts you can claim, which are tax and NIC free, are:

- £5 per night for each overnight stay anywhere in the UK (GB & NI)

- £10 per night for each overnight stay outside of the UK

The claim is to cover sundry personal expenses incidental to you being away from home, whilst visiting a temporary workplace, and may include items such as newspapers, telephone calls home, laundry, rental of films and refreshments.

You do not have to incur expenditure up to these limits and receipts are not required, however any amounts incurred in excess may not be claimed and we suggest you retain any expense receipts to prove an expense was incurred and you did stay overnight.

Tube, bus, rail, ferry, taxi and air travel

Any other travel costs to and from your home and temporary place of work may be claimed as long as receipts are provided. Oyster ticket costs can be claimed, though we recommend you top them up at a manned kiosk, where you can request a receipt. Automated top up machines do not normally issue a receipt so can cause problems. When using budget airlines, both original tickets and online receipts are acceptable.

Associated travel costs

Road, bridge and tunnel tolls and congestion charges incurred while travelling on business may be claimed. However, original receipts are required for all claims. Speeding, parking or clamping fines and penalties cannot be claimed.

Parking charges

Parking fees can be claimed as long as they are supported by a receipt or ticket detailing the time and date. These must correspond to another claim for travel such as a journey you are claiming mileage or other travel costs for. All parking costs must be related to work carried out for the sole purpose of your contract.

Training courses and tuition

Training courses, tuition or seminars necessary for your current working contract, whilst in employment with Saymore, can be claimed as long as you supply a receipt for the full amount, details of your current job description and the name and description of the training course/tuition.

Training courses and tuition may be allowable when updating skills, but not when learning new ones and must be relevant to your contract. Degree courses are not generally permitted as claimable expenses.

Please contact your AM directly for more information and advice on your specific circumstances.

Manuals and textbooks

A reasonable amount may be claimed to cover the cost of manuals and textbooks required for business purposes. Receipts are required in all cases and must be accompanied by a letter of rationale.

Manuals and textbooks may be allowable when updating skills, but not when learning new ones and must be relevant to your contract.

Telephone and mobile communications

Business related telephone calls from a landline are claimable, but a copy of an itemised bill must be provided. However, line rental cannot be claimed unless there is a genuine business need for a second line at home, which must be used exclusively for business purposes.

Similarly, business calls to and from a mobile phone or other mobile communication device are claimable. All business phone call claims must be highlighted on an itemised bill and the total should either be added to your expense form or entered online.

Professional memberships and subscriptions

Professional association memberships can be claimed, providing that the professional body is on the list approved by HMRC. Visit www.hmrc.gov.uk/list3 for further details.

Subscriptions to trade journals and magazines are not claimable.

Postage, office consumables and stationary

The cost of business-related postage, including that relating to any form of documentation with Saymore, is claimable.

Office consumables, including printer ink, pens etc and any stationery you use for business purposes may be claimed. However, the total cost must be reasonable and you will need to provide original receipts to validate your claim.

Protective, speciality clothing

A claim can only be made for the cost of specialist protective clothing if it is a requirement due to the nature of your work and it must not be suitable for everyday wear outside your working environment. Receipts are, of course, required.

Internet and fax costs

As it is generally not possible to separate business and private use, Internet costs are not an allowable expense. Fax call charges are claimable if they are solely used for business purposes and an itemised bill can be supplied.

Safeguarding you

As an Umbrella company that puts compliancy and the safeguarding of our contractors at the forefront of everything we do, we undertake regular auditing of the expense claims you submit. Any that are found to be fraudulent or excessive will be disallowed or revoked and any tax underpayment will be deducted from your next payment.

Although we do not need to see receipts in order to claim certain items, we will require that you produce receipts, for all the expenses you have claimed, should we or HMRC select you as part of the auditing process. For your additional peace of mind, we strongly suggest that it is in your own interest to always ask for receipts and store them in a safe place.